Authors: Aaron GU丨Pengfei YOU丨Duzhiyun ZHENG丨Yuzhen ZHANG丨Fengqi YU[1]

On September 7, 2023, the Center for Drug Evaluation (the "CDE") of the National Medical Products Administration (the "NMPA") released "Annual Report on Progress of Clinical Trials for New Drug Registration in China (2022)" (the "2022 Annual Report"). Compared to the Drug Review Annual Reports with major focus on the drug reviewing process (please refer to Overview of China Drug Review Annual Report (2015 – 2021)), the 2022 Annual Report is to integrate and analyze the data on clinical trials for new drug registration in China (the "NDCT") based on the information from the Drug Clinical Trials Registration and Information Publicity Platform (the "DCTRIP Platform"). In this article, key takeaways from nine (9) aspects of the clinical trials are summarized in order to present the state of the NDCT in China, including: total number of the registered clinical trials, sponsor type, drug type & registration classification, target indications, domestic/multi-regional clinical trials, clinical trial phases, leading sites & participating sites, clinical trials in special populations, initiation & completion time, by which we share our perspective on the development of China NDCT in the future.

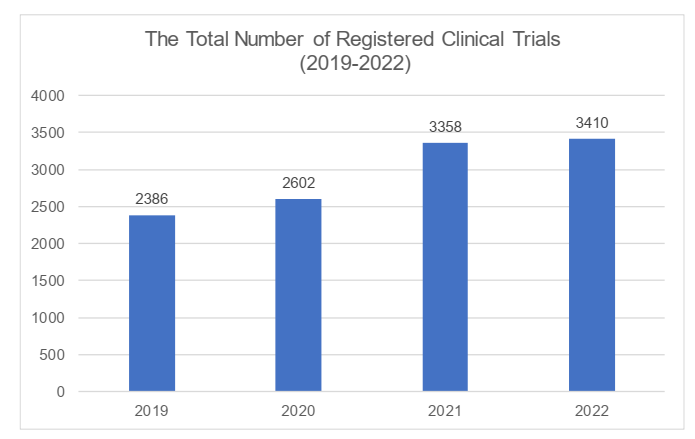

The total number of registered clinical trials

Subject to the information on the DCTRIP Platform, the total number of registered clinical trials reached 3,410 in 2022, a record high in the recent years. From 2019 through 2022, a remarkable increase was showed in 2021. However, the momentum slightly slowed down along with a growing hesitation among investors, though there was still a modest increase in 2022. Please see the changes in the below chart (based on data from DCTRIP Platform):

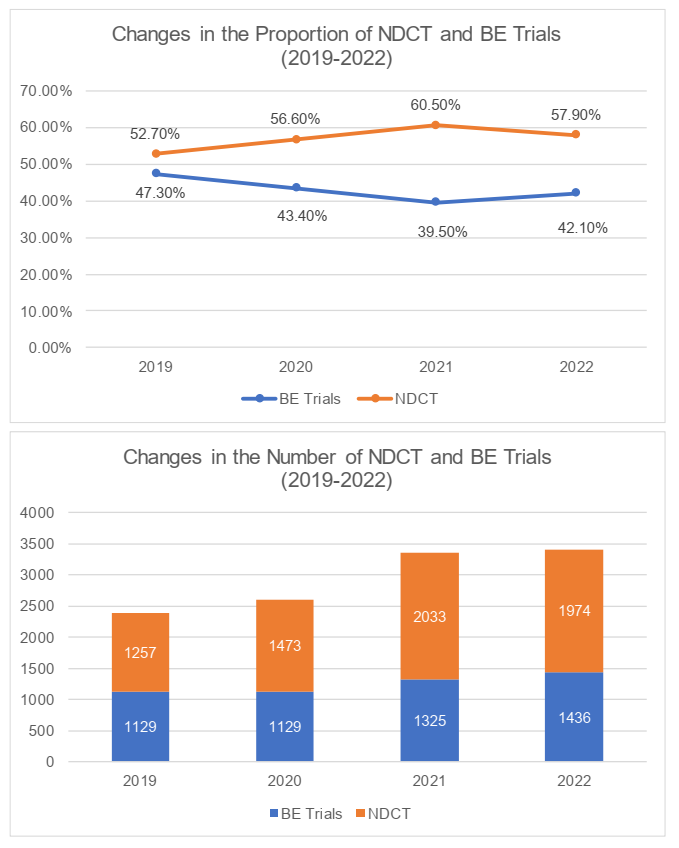

In terms of the clinical trial classification, the number and proportion of NDCT declined comparing to the past year, while the Bioequivalence (the "BE") trials had maintained its stability and achieved increases in terms of the volume. We understand that this was due to the relatively higher cost for carrying out NDCT. Due to economic environment, the deficiency of capital had caused the number of NDCT to decline further.

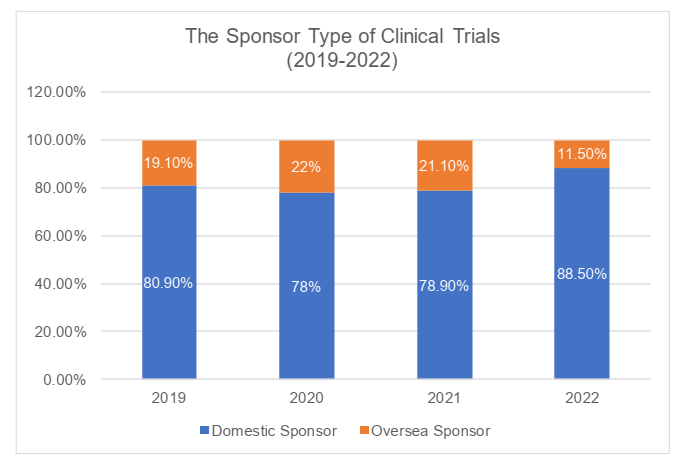

Sponsor type

In terms of the types of sponsors, the clinical trials in China had been initiated mostly by domestic sponsors. In 2022, the domestic sponsors initiated 88.5% of clinical trials. The clinical trials initiated by oversea sponsors had been increasing during 2019 through 2021 but faltered in 2022, lower than its proportion in 2019 (19.10%). It had been shown that in 2022, the domestic sponsors still accounted for the majority of total clinical trials and its proportion is still expanding significantly.

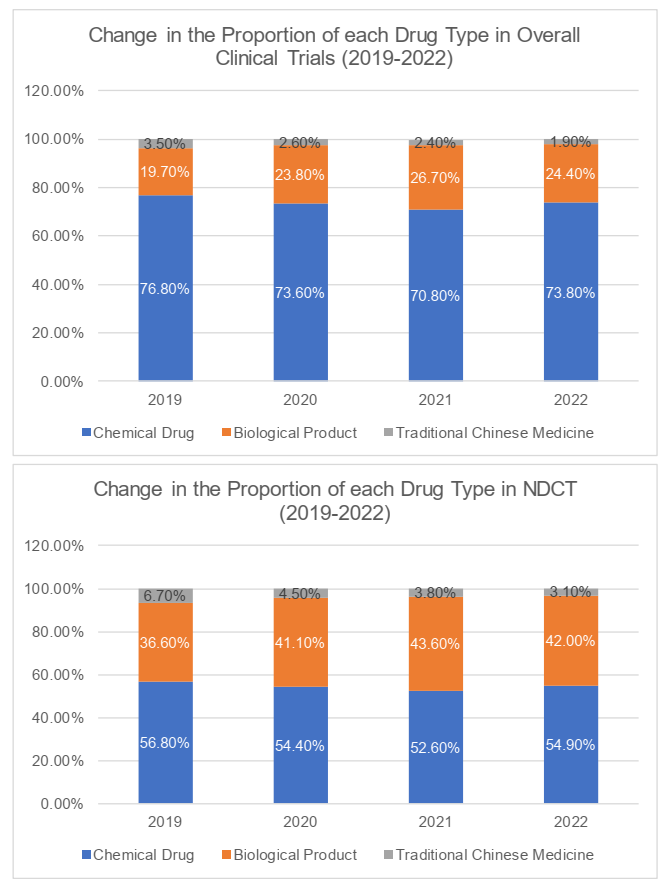

Drug type

In terms of the drug types (i.e. chemical drug, biological product and traditional Chinese medicine), clinical trials for chemical drugs generally accounted for the majority of the clinical trials in China (73.8%), followed by the clinical trials for biological products (the "BIOCT") and clinical trials for traditional Chinese medicine. The number of clinical trials for traditional Chinese medicine remained the lowest at 1.9%. Likely, more than 50% of the NDCT were clinical trials for chemical drugs. The NDCT for biological products and traditional Chinese medicine respectively occupied 42% and 3.1%.

It is worth noting that, the proportion of BIOCT and NDCT had fallen in 2022, following their consecutive increases during 2019 through 2021. We understand that on one hand, the population's demand for Covid-19 vaccines had changed and caused the decline in BIOCT; on the other, regulations and policies had been promulgated, underscoring the doctrine that "clinical trials shall put the benefit of patients at the core and be oriented by clinical value". To some extent, the above policies had discouraged the development of certain drugs lacking innovation and clinical value, such as me-too drugs.

In terms of the varieties of drugs in NDCT, in 2022, a total of 77 trials had been registered for top ten (10) varieties of chemical drugs (ranked by their number of NDCT), making up 7.1% of the total NDCT for chemical drugs, with a maximum of six (6) trials for single variety. A total of 86 trials had been registered for top ten (10) varieties of biological products making up 10.4% of the total NDCT for biological products, with a maximum of nine (9) trials for single variety. The majority of traditional Chinese medicine had only carried out one (1) clinical trial for one variety.

All along, concentration on specific targets and identical indications among drugs (the "Homogeneity") have been an issue for drug development in China, resulting in the lack of innovation and leaving patients’ real needs unaddressed. In efforts to resolve this situation, relevant policies and guidelines were introduced (for instance: the Guidelines for Clinical Value-Oriented Clinical Trials of Oncology Drug published by CDE in November, 2021) to clarify the doctrine that "clinical trials shall put the benefit of patients at the core and be oriented by clinical value", in order to raise the threshold for new drug R&D. According to the data released by CDE for the past three (3) years, the number of clinical trials for many new drug varieties reached 10 – 20 in 2020 and 2021. However, in 2022, this issue had been improved.

In terms of the cellular and gene therapy (the "CGT"), the target indication primarily focused on the field of anti-tumor. Most of the trials were Phase I trials.

In terms of BE trials, there were still many trials amassed for single variety. All of the top ten (10) varieties had more than (ten) 10 trials, with a maximum of 18.

Target indication

In consistence with the previous years, oncology continued to be the principal indication for the NDCT for chemical drugs and biological products, occupying 36.7% of the former and 48.1% of the latter. In terms of traditional Chinese medicine, there were five (5) main target indications including respiratory, digestive, skin and ENT, psychoneurotic and gynecological diseases, etc. In recent years, concentration on specific targets and Homogeneity have been a wide concern among the industry. It is a shared goal and direction, for research personnel, pharmaceutical companies and investment companies, being oriented by the clinical value and not by excessive competition, to find a way to achieve more advanced innovation, thereby address the patients’ real needs.

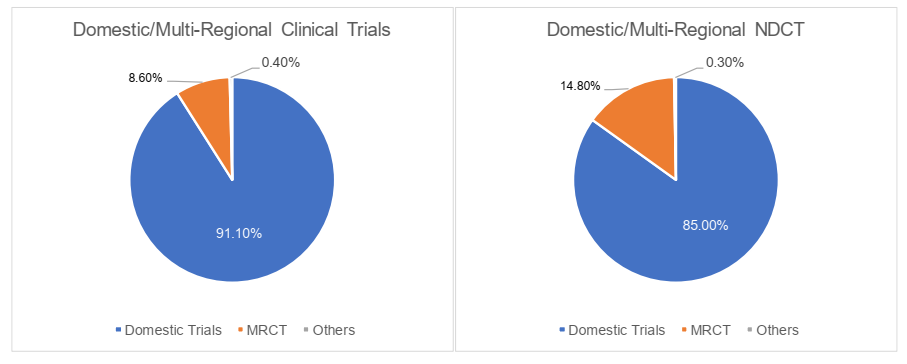

The domestic/multi-regional clinical trials

In 2022, the domestic clinical trials were primarily dominated by domestic projects in China, occupying 91.1% of the total clinical trials, while the multi-regional clinical trials (the "MRCT") only made up 8.6%. Specifically, MRCT accounted for 14.8% of NDCT, which was comparatively higher than that of total clinical trials. The registration classification was revised by the Work Plan of the Reform on the Chemical Drug Registration Classification promulgated in 2016 and the Drug Registration Regulation amended in 2020. Unlike the registration classification in 2007, a new drug by definition has to be globally "New" as opposed to simply domestically "New", i.e., the drug to be registered as "New Drug" shall neither be marketed domestically nor globally. We understand that this shift of definition spurred more MNCs to carry out R&D and clinical trials simultaneously in China. Hence more MRCT were registered accordingly.

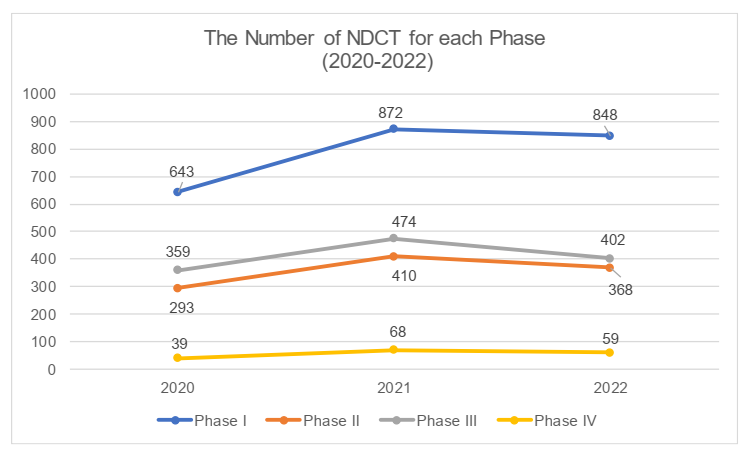

The phases of clinical trials

In 2022, the proportion of each phase of NDCT remains basically consistent with the previous years. The proportion of Phase I trials is the highest, reaching 43%, followed by Phase III trials (20.4%) and Phase II trials (18.6%), with Phase IV trials having the lowest proportion. All phases had seen a shrinking volume of clinical trials due to the flagging enthusiasm among investors. We understand that as result of increasing pressure on liquidity, certain companies with prudent decision makers had been more inclined to cut spending on the non-core pipelines that had not achieved satisfactory performance and with a small market, but only kept their essential pipelines.

Leading sites and participating sites

In terms of geographical distribution, the leading sites were still mainly in Beijing, Shanghai, Guangdong and Jiangsu etc., among which Beijing had the most leading sites of clinical trials. The following cities/provinces were having the most participating sites: Guangdong, Beijing, Jiangsu, Zhejiang etc., among which Guangdong has the most leading sites of clinical trials. In 2022, 41% of the clinical trials had been participated by the overseas institutions.

Based on the information in the 2022 Annual Report, there are disparities among cities/provinces in terms of their access to clinical trials. Prior to the Drug Administration Law (the "DAL") as amended in 2019, the administration over clinical trial sites was based on the control of qualifications. After the DAL was amended, the qualification control was replaced by a filing procedure. We understand that this shift of control was meant to encourage and facilitate more medical institutions to participate in clinical trials. However, due to multiple factors such as the amount of capital and research personnel, the disparities are still noticeable among cities and provinces in practice.

Additionally, from the perspective of initiation time, the clinical trials carried out in the regions with more leading sites were usually taking longer time, by contrast, the regions with fewer leading sites (for instance, Hainan and Liaoning), were seen with faster initiation of clinical trials. We understand that for one thing, it reflects the imbalance among different regions for their access to clinical resource; for another, the more advanced sites with more experiences are usually followed by more projects thereby calls for a longer initiation time.

Clinical trials in special populations

Clinical trials in special populations are mainly referring to the clinical trials in elderly population, pediatric population and clinical trials on rare diseases. In 2022, the proportion of clinical trials participated by elderly population was comparatively high, reaching 72.3%, but there was only one (1) trial solely participated by the elderly. By contrast, the proportion of clinical trials participated by pediatric population was low, only making 8.3%. There were 64 clinical trials registered and solely participated by the pediatric population. In the recent years, the clinical trials on rare diseases had shown consecutive increases, in 2022, the number of registered trials reached 68.

In these years, it has been encouraged by the authority to pay more attention to the elderly population, pediatric population and population with rare diseases. The safety, efficacy and availability of treatment to underprivileged populations should be a crucial public concern and a major aspect of the social welfare. However, the therapy for pediatric diseases and rare diseases are normally characterized by difficult R&D, lengthy cycle and high costs, resulting in a lack of motivation among companies to carry out R&D to these diseases. Recently, the authority has attempted to motivate R&D for the said drugs by promulgating a flurry of polices including a mechanism of priority review & approval, aiming to enhance the enthusiasm among companies. We are also looking forward to seeing more positive changes in the days to come.

Registration, initiation and completion of clinical trials

I. Registration

The 2022 Annual Report analyzes the time taken for clinical trial registrations for approvals and BE filing registrations, i.e., time from the date of the initial submission of the corresponding registrations to the date of acquisition of the implied approvals or BE filings for drug clinical trials. In 2022, the time spent for a clinical trial registration for approvals was 116 days on average, with the maximum not exceeding 328 days. Over half of the clinical trial registrations for approvals required more than two (2) months to be completed. On the other hand, the time spent for a BE filing registration was 67 days on average, with the maximum not exceeding 221 days. Most of the BE filing registrations could be completed and submitted within one (1) or two (2) months. Therefore, normally, the time for clinical trial registrations for approvals had been significantly longer compared to that for BE filing registrations.

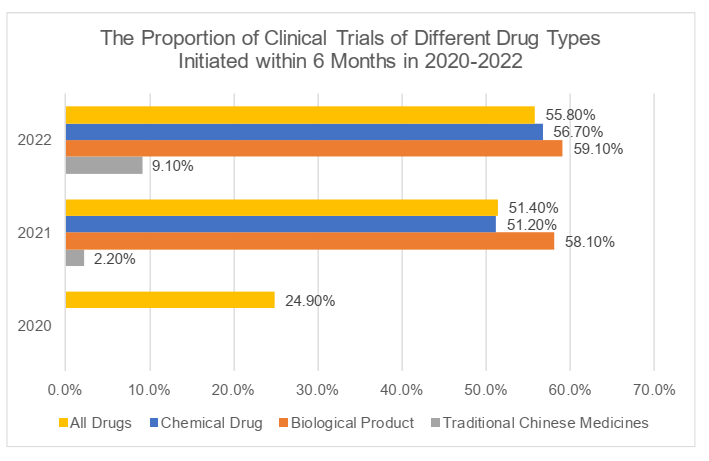

II. Initiation

The analysis of the initiation of clinical trials focuses on the time spent from the approval date of clinical trials to the date of the first recruitment with informed consent (the "ICF"). It took 48 months on average with a maximum of 207 months for the initiation of clinical trials in 2022. More than half of the trials (55.8%), including more than half of trials of chemical drugs and biological products (respectively 56.7% and 59.1%) in 2022, might initiate subject recruitment within six (6) months, while only 21.2% of trials of traditional Chinese medicines might initiate subject recruitment within one (1) year although the proportion had significantly increased compared with that in 2021 (4.4%) (For more information, please refer to the charts below). As mentioned in the previous articles, the clinical trials of traditional Chinese medicines have specialties, compared with those of chemical drugs and biological products, in the clinical positioning and efficacy evaluation, as well as the collection and application of patients' user experience (for our analysis on the clinical trials of traditional Chinese medicines, please refer to 汉坤 • 观点 | 中药之春?从《中药注册管理专门规定》看中药特色上市评价体系). The low quantity and implementation efficiency of trials of traditional Chinese medicines have been explicitly listed as one of the key issues in the 2022 Annual Report. We eagerly look forward to any beneficial policies and regulations which may be carried out in the future to improve the implementation efficiency of such trials and encourage relevant parties to deepen the inheritance and innovation of traditional Chinese medicines.

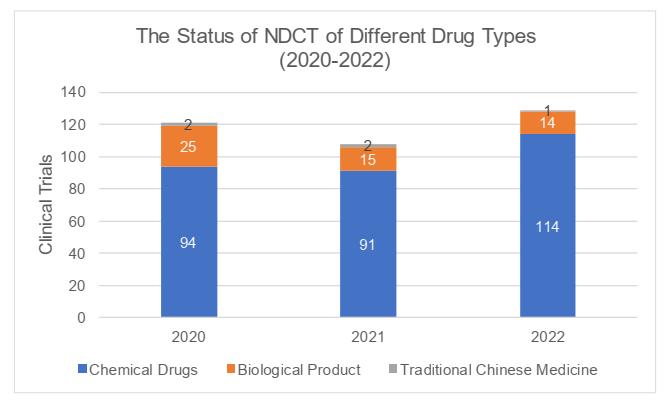

III. Completion

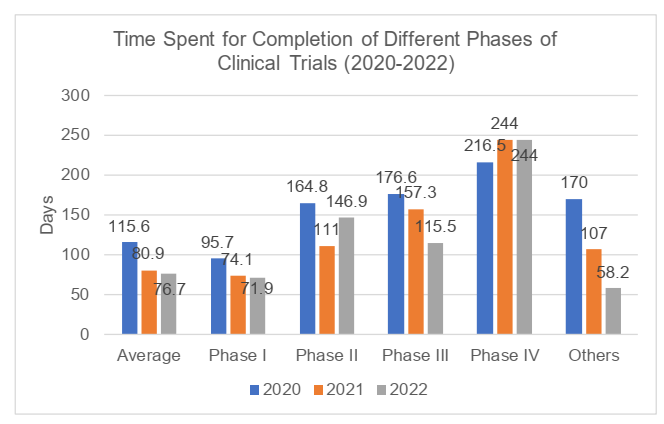

According to the 2022 Annual Report, a total of 129 clinical trials were completed in 2022, and the number had slightly increased compared to 2021 and 2020 (respectively 108 and 121 trials). In 2022, the time from the date of the first recruitment with ICF to the date of completion of the clinical trials was 76.7 days on average, with a maximum of 258 days, and the average time had decreased compared with that in 2021 and 2020 (respectively 80.9 and 115.6 days). The completed trials were mainly Phase I trials (with the proportion of 72.9%) with average time of 71.9 days, while Phase IV trials took the longest average time of 244 days. For detailed information, please refer to the charts below.

According to the 2022 Annual Report, nine (9) clinical trials were voluntarily suspended, and 16 trials were voluntarily terminated. As enumerated in the 2022 Annual Report, the adjustment of R&D strategies had been the most common reason for suspension or termination for the second consecutive year, while other reasons might also cause suspension/termination, including protocol design issues, limited clinical benefits, production issues, trial quality issues, trial funding issues, safety risks, etc.

Conclusion

In recent years, the development of NDCT has been slowed down due to the impact of various environment and background factors. Multiple issues have remained unsolved according to the 2022 Annual Report, for example, the Homogeneity in the clinical trial drugs remains significant, and the geographical distribution of leading and participating sites has been significantly concentrated, which may restrict the implementation efficiency of clinical trials. Also, despite the key support from the regulatory authorities on traditional Chinese medicines, there is still room for further development in the quantity and efficiency of clinical trials for traditional Chinese medicine. However, we should also note that with the continuous acceleration of the innovation and development of new drugs, the number of NDCTs has shown a rapid growth by the end of the first half of 2023, and the implementation efficiency of clinical trials has also been significantly improved. New forms of clinical trials, such as decentralized clinical trials (the "DCT"), have also been explored and supported by the regulatory bodies (for our interpretation on the DCT regulations, please refer to China DCT Regulation and Implementation). Therefore, we understand the NDCT in China has shown a positive and prosperous future and trend, and joint efforts from both regulatory authorities and enterprises are still required to solve the up-mentioned issues and further improve the quantity, efficiency and quality of NDCT in China. We will, together with the industry, continue to pay due attention to the latest development and regulatory trends of clinical trials in China.

Important Announcement |

|

This Legal Commentary has been prepared for clients and professional associates of Han Kun Law Offices. Whilst every effort has been made to ensure accuracy, no responsibility can be accepted for errors and omissions, however caused. The information contained in this publication should not be relied on as legal advice and should not be regarded as a substitute for detailed advice in individual cases. If you have any questions regarding this publication, please contact: |

|

Aaron GU Tel: +86 21 6080 0505 Email: aaron.gu@hankunlaw.com |

[1] Leyi Wang and Shuwen Sun have contributions to this article.